Ukraine’s Energoatom scandal exposes deep corruption rooted in its centralized Soviet-era energy system. The investigation reveals Russian-linked networks, systemic kickbacks, and urgent need for decentralized renewables and EU-aligned reforms.

Ukraine and Canada Launch Partnership in Geology and Minerals

Ukraine and Canada have signed a two-year cooperation agreement in geology and mineral resources to modernize geological data, advance digital transformation, and attract global investment into Ukraine’s critical minerals sector through a joint committee.

Belgium blocks Russian assets: shrinking funds for Ukraine

Belgium blocked a European Union plan to channel profits from frozen Russian assets to Ukraine. Brussels benefits from Euroclear tax revenue and leverage, while delays mean less money for Kyiv and a plan held hostage by European Union unanimity rules.

PRC, India Slash Russian Oil Buys as EU Tightens Energy Sanctions

China and India are curbing direct Russian oil purchases after new U.S. sanctions, while the EU’s 19th package tightens energy measures and targets the shadow fleet. Moscow escalates rhetoric, battlefield attacks intensify, and partners boost aid to Ukraine.

EU Russian LNG ban 2027: Spain’s Enagás says switch to US gas

EU Russian LNG ban 2027 moves closer as Spain’s Enagás confirms it can halt Russian cargoes and replace with US LNG. Brussels readies rules to verify gas origins and a phased exit, aiming to cut Kremlin revenues and reduce energy reliance. EU states draft LNG penalties.

Frozen Russian Assets Ukraine: EU moves to lock in long-term aid

With United States funding uncertain and European Union budgets stretched, Brussels aims to anchor Ukraine support in loans backed by frozen Russian assets. A proposed €140bn facility, Euroclear guarantees and G7 coordination face Belgian concerns and legal hurdles.

Gasoline Shortages in Russia as Ukrainian Strikes Intensify

Gasoline shortages in Russia are worsening as Ukrainian strikes disrupt key oil infrastructure, forcing regions to ration fuel. Rising prices, suspended refinery operations, and restrictions across major oblasts underscore growing pressure on Russia’s energy system.

Russia oil and gas revenue slump reshapes 2026 war budget

Russia’s oil and gas revenue is set to drop 23% in September, straining the Kremlin’s main war-funding stream just as Putin drafts the 2026 budget amid record military spending, tax hikes and mounting signs of stagnation, recession risks and deepening fiscal stress.

Russian real estate war crisis pushes developers toward bankruptcy

Russian real estate war fallout is driving nearly a fifth of developers to the edge of bankruptcy, a share that could soon exceed 30 percent. Soaring interest rates, collapsing demand and bad loans are crippling mass housing projects, forcing authorities to consider drastic measures.

Russian developer bankruptcies signal deepening financial collapse

Russia’s housing market is collapsing as high interest rates, frozen projects, and shrinking mortgage demand push up to 30% of developers toward bankruptcy, forcing the Kremlin to consider emergency state intervention to prevent systemic failure.

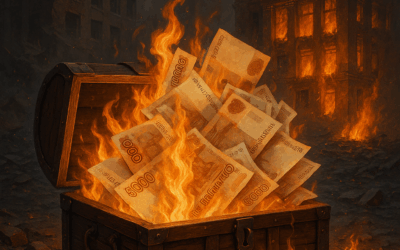

Russia’s War Chest Crisis: Liquid Reserves Could Collapse by Christmas

Russia’s war chest is nearing empty as sanctions drain reserves, oil revenue falls, and labor shortages intensify. With liquid funds possibly gone by Christmas, the Kremlin faces a tightening fiscal crisis that threatens its long-term war strategy.

Germany’s Evolving Military Aid to Ukraine, April 2025 Snapshot

As of April 17, 2025, Germany’s archive lists about €28 billion in military aid to Ukraine, mixing Bundeswehr stock transfers with industry buys. Deliveries include Patriot and IRIS-T air defences, Leopard tanks, PzH 2000s, drones, mine-clearers, and extensive logistics.