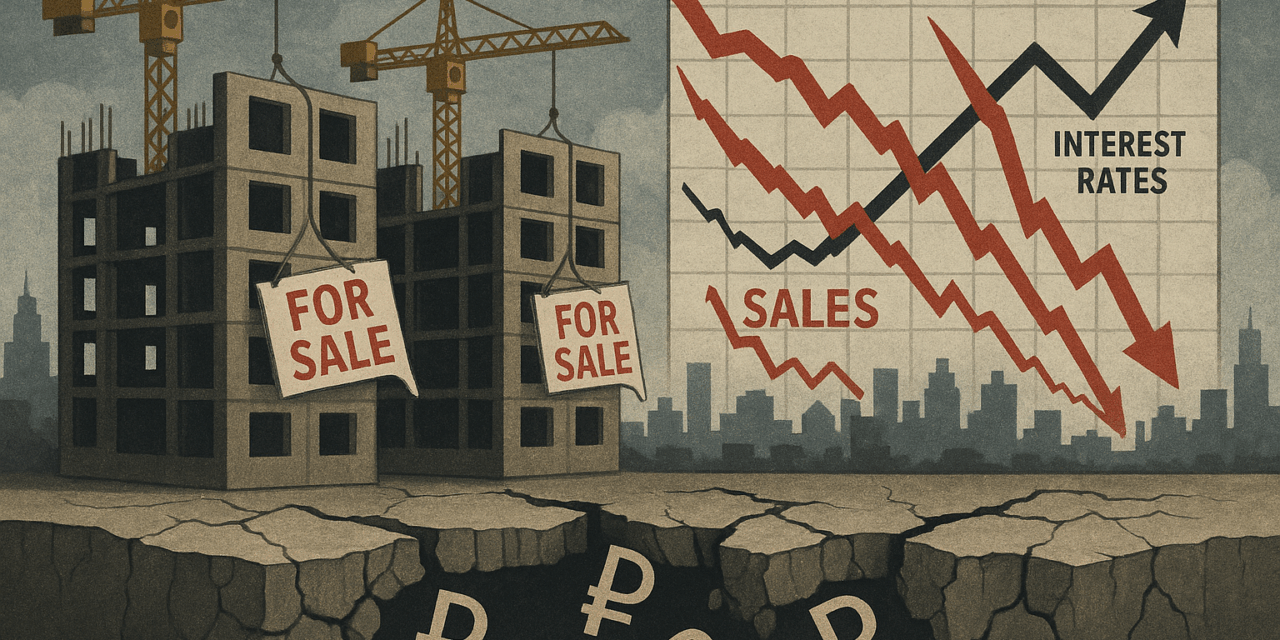

Russian real estate war damage is becoming one of the most visible domestic costs of the invasion of Ukraine. Nearly 20 percent of developers are now on the brink of bankruptcy, and analysts warn that the share could soon surpass 30 percent. The crisis reflects a toxic mix of collapsing sales, high interest rates, and war-driven uncertainty that has gutted what was once a key engine of Russia’s urban growth.

From boom to bust in mass housing

For years, Russia’s housing market thrived on large-scale projects and easy mortgages, often supported by state subsidies. Developers built vast estates of apartment blocks on the edges of major cities, banking on steady demand from middle-class families. The war has shattered that model. Real estate investment fell 44 percent in early 2025, and more than half of mortgage applications are now rejected, even for borrowers who look creditworthy on paper.

Interest rates, inflation, and fearful buyers

The central bank hiked interest rates to tame inflation and stabilise the rouble, but higher borrowing costs have slammed housing demand. Potential buyers hesitate to take on large debts in a time of economic uncertainty and mobilisation. Those who do apply for mortgages often fail stricter bank checks, leaving developers with unsold units and shrinking cash flow. Rising bad loans deepen the spiral, as banks tighten lending further to protect their balance sheets.

State response and long-term consequences

Faced with the risk of a systemic crash, authorities are considering extraordinary measures such as suspending bankruptcies for developers or using public funds to complete stalled projects. These steps might prevent immediate social unrest—angry buyers, unfinished buildings, job losses—but they also lock the state more deeply into a failing model. Russian real estate war crisis therefore illustrates how overseas aggression boomerangs back into domestic economic pain, turning once-glittering new districts into symbols of a squeezed, unstable middle class.